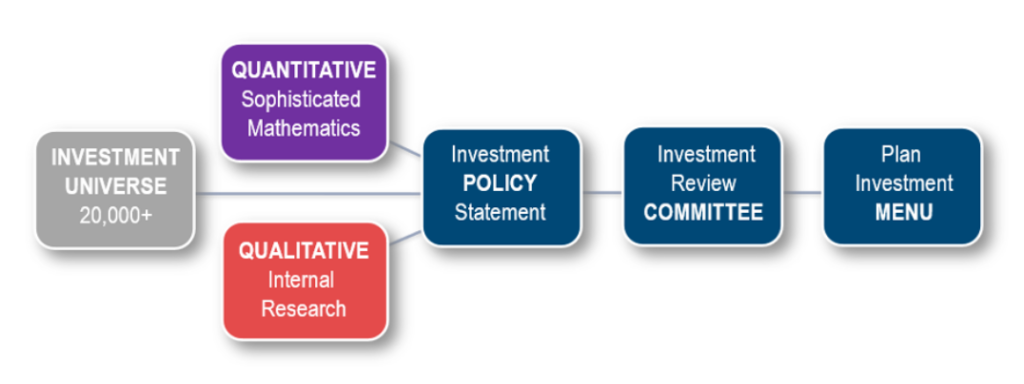

The Scorecard System was created as a way to score funds based on multiple criteria commonly used today by institutional investors and money managers.

The result is a straightforward 10-point numerical scoring system that can be used to monitor funds and/or managers. The objectives of the Scorecard System are to:

- Identify skillful managers

- Enhance investment opportunities

- Manage and control risk

- Minimize exposure to fiduciary liability

RPAG® Scorecard System Unique Differentiators

Qualitative factors are important to consider alongside the more objective, quantitative analysis. Ultimately, fiduciaries need to research and understand the rating systems utilized in selecting and monitoring funds, as they are all different in their construction and methodology. Unbalanced rating systems can lead investors to draw false conclusions.

The qualitative review process is structured in its approach and designed to identify the factors that will ultimately drive future investment performance. The three primary factors include people, processes, and philosophy.

The baseline criteria are set for each:

People

Is there an experienced team with the ability to manage both philosophy and process? You must weigh factors such as changes within the firm’s leadership and organization, as well as the experience and ability of a portfolio manager.

Process

Is the process clearly defined and consistently applied? Is the process sound and established? The implementation of a strategy may be just as important, if not more important, than the ideas and research supporting it.

Philosophy

The research and ideas must be coherent and persuasive, with a strong rationale supporting past results and future performance expectations.

Our proprietary Scorecard System provides a proven process to monitor and evaluate both fund managers and investment strategies. It is an institutional approach that is comprehensive and independent and utilizes a well-documented process and methodology.